Contents:

The very first generation of internet-based foreign exchange trading platforms emerged in 1996, making it possible for foreign exchange to develop at a much faster pace and for customer markets to expand. As a result, web-based retail foreign exchange allowed individual customers to access the global markets and trade on currencies directly from their own computers. Automated trading is undoubtedly one of the most popular features of MetaTrader 4. It is remarkable data in itself that since 2014, over 75% of the United States stock share trades, including NASDAQ and the New York Stock Exchange, have been carried out through automated trading system orders. The fact that today automated trading on the MT4 software is also available for retail traders and investors is a huge plus, allowing trading not only on stocks but also on foreign exchange , futures and options. For most online traders and investors, whether they are trading forex or CFDs , MetaTrader 4, is undoubtedly a household name today.

Each symbol can be displayed in 9 time-frames, allowing traders to see the price dynamics in detail. 30 built-in technical indicators and 24 graphic objects are available for the most comprehensive analysis of price dynamics. Combine these tools, identify trends, determine entry and exit points and with wide analytical capabilities of MetaTrader 4 you can thoroughly analyze market movements to catch the best time to trade. The MetaTrader 4 trading platform is designed for Forex and futures trading. With MetaTrader 4, traders can analyze financial markets, perform advanced trading operations, run trading robots and copy deals of other traders.

Usage of MetaTrader (MT

77.37% of retail investor accounts lose money when trading CFDs with this provider. Additionally, potential mechanical failures can also affect the outcome of trades carried out by the automated system, and many traders with poor internet connection are compelled to also manually monitor trades being handled by automated trading. Whether you are considering trading Forex in MetaTrader 4 with a demo account, or a live account, you should consider taking a look at the MetaTrader Supreme Edition plugin. This is because MTSE greatly increases the scope of the platform. MTSE is a custom plug-in that expands the number of indicators available, as well as offering a wide array of cutting edge trading tools.

Signals are not currently available on CAD and JPY denominated accounts. The signal service does not constitute and should not be regarded as investment advice. Access 30 of the most popular technical indicators, three chart types, nine time frames, 24 analytical objects, plus free chat and email with the largest community of traders. If you are wondering what the investor password is for, which should be included in your account details email, this allows access to view the account, but not to trade. So, you can see open positions, balances, live prices and even use Expert Advisors, but not trade. The investor password grants a MetaTrader 4 broker or trader the ability to let another person see how trading on MT4 works.

MT4 Vs. MT5 – Differences Between Metatrader 4 & 5? – DailyForex.com

MT4 Vs. MT5 – Differences Between Metatrader 4 & 5?.

Posted: Sun, 27 Nov 2022 08:00:00 GMT [source]

For those who are completely new to trading, it is recommended to practice on a demo account before making the transition to a live MetaTrader 4 account. The process for opening a live account does not differ greatly from that of opening a demo account. Nevertheless, we will walk you through both processes in the following sections. Optimize your strategy with a suite of over 20 expert advisors and custom indicators to give you professional-grade control and flexibility over your trading strategy. All apps are provided by FX Blue and included with a FOREX.com MetaTrader account.

Popular Platforms

The MetaTrader 4 web platformallows you to trade Forex from any browser and operating system with no additional software. Access your account and start trading in just a couple of clicks. Bill Williams is an influential figure in the world of trading psychology and technical analysis. His fame spread rapidly in the 1990s due to his ‘Trading Chaos’ series of books, as well as the range of popular indicators that he invented. He has been operating as a trader and analyst for more than…

20 Best Crypto Copy Trading Platforms: A Curated List 2023 – Coin Culture

20 Best Crypto Copy Trading Platforms: A Curated List 2023.

Posted: Fri, 10 Mar 2023 08:00:00 GMT [source]

The chi sq Accountprovides access to the same markets as our Standard Account but with tighter spreads, as low as 0.2 on EUR/USD. You’ll then pay a low $5 commission per 100k on your Commission Account. Both our Standard Account and Commission Account are REST API compatible. Deposit as little as $100, though we recommend starting with at least $2,500 to allow you more flexibility and better risk management when trading your account.

Automated Trading and MQL

Dedicated to providing an ultimate trading experience, AvaTrade wishes to enrich all its traders, allowing them to learn how to turn market opportunities into profit. FXCM Markets LLC («FXCM Markets») is incorporated in St Vincent and the Grenadines with company registration No. 1776 LLC 2022 and is an operating subsidiary within the FXCM group of companies (collectively, the «FXCM Group» or «FXCM»). FXCM Markets is not required to hold any financial services license or authorization in St Vincent and the Grenadines to offer its products and services.

The application is safe to use – all transmitted data is securely encrypted. If you wish, you can choose to accelerate the order execution process by choosing one-tap trading, with no secondary confirmation. It has all the tools and indicators, and is the only way to access Expert Advisors.

From here, Admirals will review your application, after which we will contact you by email with the results of your application. If you are using Windows head over to the MetaTrader 4 download page, fill in your details and begin your download! For those of you who want to download MT4 for Mac, have a read of our article ‘How to Install MetaTrader 4 For Mac’ to help you get started. Remove something if you want to add this account to the comparison. Award results are determined or based on a) votes cast or survey responses by participants of the given website or organization, or b) comprehensive internal review and vetting of the awarding body and/or select panel of judges.

Interested in learning how to open a MetaTrader 5 demo account? In this article, we will explain in detail how to open and start trading on a MetaTrader 5 account. Table of Contents MetaTrader 5 | Choosing a Broker MetaTrader 5 | Download Creati… Hopefully, now you know how to open both a live MetaTrader 4 account and a MetaTrader 4 demo account.

Manage your MetaTrader account your way

MetaTrader 4 was designed by taking into account all the requirements of the 21st century technology and thus it ensures flexibility at its very best, the core of this being mobility. This is exactly why the MT4 mobile trading option allows investors to also access the trading platform, apart from their Windows and Mac operating system based PCs, directly from their smartphones and tablets. Trading portfolio as well as multiple trading account management and/or monitoring is thus possible practically speaking on the go. The trading programs written in the MQL4 programming language serve different purposes and present traders with various features. Expert advisors, which are linked to specific charts, provide valuable information to online investors about possible trades and can also perform trades on their behalf, sending the orders directly to the trading server.

- Safety in Numbers -Over 300,000 clients, seven regulations, 16 offices and over 400 employees globally.

- Access your account and start trading in just a couple of clicks.

- With MetaTrader 4, traders can analyze financial markets, perform advanced trading operations, run trading robots and copy deals of other traders.

- However, if you are a new client you will need to provide us with all the necessary verification documents (i.e. Proof of Identity and Proof of Residency).

- Copy trading with Signals’ subscriptions and Expert Advisors purchases from the MetaTrader Market are also available for demo accounts.

Whether you are considering opening a demo or live trading account, you will need to get the MetaTrader 4 download and install the MetaTrader 4 software on your computer. After registration has been completed, the new account will appear in the «Navigator – Accounts» window, and it is ready to work with. At that, the server sends a message to the terminal containing login and passwords of this newly opened account. This message can be found in the «Terminal – Mailbox» window. Besides, after the account has been successfully registered, it will be authorized automatically. Raw Trading Ltd does not endorse any of the material contained in Chats or Chat groups.

Do I need a separate account to trade on MT4?

Addresses of available servers, their names and ping are listed there. To perform additional checking the ping, you should press the «Scan» button. MAM –The perfect environment for the Money Manager, running multiple accounts. Professional –High leverage, low spreads, hedging and scalping available. Enter your details & select the platform you wish to trade with. Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders.

Discover the latest trading trends, get actionable strategies and enjoy complimentary tools. You may request an additional account by logging into MyAccount, going to your Account Settings and selecting Add New Account. When you trade on your MT4 account with FOREX.com, you’re getting the most out of your trading potential.

The MetaTrader 4 platform update will be released on Friday, March 24, 2023. This version provides error fixes and platform stability improvements.

– if this option is chosen, it is necessary to fill out the «Login» and «Password» fields with the corresponding account details. A server selected at the previous step is displayed below these fields. You will be authorized at the specified server using the specified account as soon as you press the «Done» button.

https://1investing.in/4 encompasses a great number of functions that enable traders to analyse previously received and current quotes, follow price changes by means of built-in technical indicators and not just manage but continuously control their trading orders. Trade on one of the world’s most popular trading platforms with access to dedicated trading tools exclusive to FOREX.com. Unlike most standard MetaTrader platforms, you’ll have access to fully integrated Reuters news, FOREX.com research, Trading Central technical analysis, and account management tools. If you are just a beginner, this is a great way to start, until you are ready to make a live account on MetaTrader 4. A demo account is the best way for newcomers to explore trading.

Additionally, mobile trading also provides a wide array of analytical options and the graphical display of quotes for proper account management. Since the MT4 mobile trading options are exactly the same for smartphones and tablets as for trading from table PCs, online investors can perform their trading activities at the same speed and with the same trading tools for best results. Suitable for both beginner and seasoned traders with versatile investment skills and practices, MT4 can be regarded today’s ultimate trading software in virtually every spot of the globe. Backtesting (i.e. testing trading strategies on prior time periods) is yet another advantage of automated trading in that it applies trading rules to historical market data and so it helps investors assess the efficiency of several trading ideas. On applying proper backtesting, traders can easily evaluate and fine-tune trading ideas, which they can later apply in their own trading practices for better results.

Such material should not be regarded by you as investment advice, a personal recommendation, an incentive, or an inducement to trade. You should undertake your own independent research and investment decision as to whether a trading strategy, style, portfolio is appropriate for you. Information posted on the IC Social portal can only act as input to the process.

FOREX.com with MetaTrader 4 combines exclusive tools with tight spreads and superior execution. – the basic currency of the deposit to be set automatically depending on the account type selected. – account type to be selected from the list defined by the brokerage company. At this stage a user can specify details of an existing trade account or start creating a new one. The first stage of account opening is selection of a server to connect to.

The first element is installing the actual MetaTrader 4 platform. The second element is all about how to set up a trading account — with which you log in to MetaTrader. Trade on the fully featured, browser-based application of the platform with no additional downloads or plugins. Open an Account» menu command or by the same command of the «Navigator – Accounts» window context menu. Besides, the terminal will offer to open a demo account at the first program start to begin working immediately.

Содержание

- Операции с гривной

- Инсайты от экспертов банка

- Как вернуть деньги от брокера — мошенника самому и бесплатно

- У меня есть иностранные ценные бумаги. Как мне узнать, заблокированы ли мои бумаги, и если да, то сколько и какие?

- Контактная информация

- Visa и Mastercard пригрозили банкам штрафами из-за комиссий Wildberries

- Направьте обращение в банк-эквайер

Итог беседы — Сбербанк будет оспаривать мою транзакцию. А в написании заявления и дополнительного письма мне очень помогла Ваша статья. Ограничение на которое они так ссылаются это на стр 44.единственное?

Через неделю начал атаковать продавца с вопросами о сроках доставки. Не получив ответа, обратился в банк за чарджбеком. Ограничений по сумме для кода оспаривания 30 не установлено. Как и при использовании платёжной системы Visa, срок для оспаривания транзакции составляет, как правило, 120 дней. А вот перечень оснований различается, хотя можно отметить не мало совпадений по сути.

Операции с гривной

Если так, то это «нормальное» действие со стороны недобросовестных брокеров. Прикладывали ли Вы к заявлению на чарджбек скриншоты, подтверждающие наличие у Вас положительного https://xcritical.com/ru/blog/skolko-platezhnykh-sistem-nuzhno-brokeru/ баланса на платформе? Если нет, то таким образом брокер может хотеть опровергнуть Ваш довод. Или причина может крыться в том, что Ваши скриншоты с недостатками.

Поэтому при расчете годового НДФЛ положительный финансовый результат, полученный на спот-рынке Московской Биржи, будет уменьшен на убыток, полученный от операций с фьючерсами на индекс РТС. В противном случае бумаги будут учитываться по нулевой стоимости и после продажи налогом будет облагаться вся полученная выручка. Еврооблигации – это облигации, преимущественно номинированные в иностранной валюте. Эмитенты выпускают облигации, чтобы профинансировать текущую деятельность и новые проекты компании. Еврооблигации бывают корпоративными и государственными.Долгое время еврооблигации, как инструмент инвестирования, были доступны только банкам и юридическим лицам – профессиональным участникам рынка ценных бумаг.

Инсайты от экспертов банка

Если владеете английским и в состоянии читать гайды, я бы посоветовала действовать самостоятельно. Требовать от банка через суд подать документы на чарджбек (положительные решения в практике есть). 2018 самая по июль и с сентября по декабрь м-ц пострадала от брокера. Обращалась юрфирму Щит и меч просили 600$ и за услуги 15% можно ли ми доверять. Не припомню, чтобы от ЦБ мы получали вразумительные ответы. Написать в Visa Вы можете, препятствий для этого нет.

Многие привыкли снимать в банкомате рубли, а затем менять их. А ведь можно снять сразу доллары или евро. Если трейдинг бинарными опционами является для вас единственным источником заработка, тогда есть смысл рассмотреть вариант формирования индивидуального предпринимательства с последующей уплатой налогов. При правильном заполнении отчетных документов штрафы исключены. Даже если при стабильном и хорошем заработке не желаете платить налог, это значит, что и в ПФ не поступают отчисления, таким образом, вы сами себе на старость ничего не откладываете.

Как вернуть деньги от брокера — мошенника самому и бесплатно

Фридом Финанс обязан соответствовать применимому законодательству в области защиты персональных данных в составе Информации, а также условиям договоров между Фридом Финанс и ее клиентами. Информационно-аналитические услуги и материалы предоставляются ООО ИК «Фридом Финанс» в рамках оказания указанных услуг и не являются самостоятельным видом деятельности. Также ограничения могут быть наложены внутренними процедурами и контролем ООО ИК «Фридом Финанс».

Не совсем понятно, какой вид деятельности следует указывать при регистрации ИП. Ведь как уже говорилось выше, в России налогообложение опционов законодательно не урегулировано. Специалист высокой квалификации работает, как правило, за определенный процент, и, если доход исчисляется несколькими десятками тысяч долларов, стоит прибегнуть к его услугам. А что делать при гораздо более скромных заработках? Вряд ли найдется профессиональный юрист или бухгалтер, готовый отвечать за наши налоги с бинарных опционов, довольствуясь процентом от пары сотен долларов. Гораздо лучше обстоит дело с платежными системами типа Вебмани, Скрилл и так далее.

У меня есть иностранные ценные бумаги. Как мне узнать, заблокированы ли мои бумаги, и если да, то сколько и какие?

Банков в 215 странах мира, обеспечивая единый формат проведения платежных операций между иностранными контрагентами в безопасной финансовой среде. SWIFT – международная система денежных переводов, которая позволяет переводить деньги между банками разных стран. Наличие SWIFT-кода говорит о надежности банка и безопасности переводов за границу для физлиц и организаций. Как работает SWIFT и кто может пользоваться этими переводами – читайте в нашей статье.

- Время ожидания ответа может составлять от 30 до 160 дней.

- То есть даже новички со $100 в Terra Trade имеют возможность практиковать трейдинг с соблюдением осторожного риск-менеджмента.

- Все вышестоящие депозитарии и регистратор видят лишь ограниченный набор данных.

- Можно выбрать объектом налогообложения «доходы» и платить 6% с полученной прибыли.

- Благодаря бездилинговой обработке транзакций и сотрудничеству с ведущими поставщиками ликвидности компания Alpari International обеспечивает надежное исполнение без перекотировок.

Второе, как можно доказать, что брокер не являлся тем кем за себя выдавал и вообще не выводил ваши деньги на рынок. Ведь тогда по факту он не являлся брокером и не предоставлял вам услуг по инвестированию. Стало быть тут подходит пункт о невыполнении условий договора продавцом услуг. У меня подвисли приличные деньги у одного из таких «брокеров», хотелось бы попытаться хотя бы их вернуть. Или всё-таки реализация права на чарджбэк — это более широкое понятие, когда банк-эмитент связывается с банком-эквайером и допустим, получает отказ, т. Когда банк-эмитент совершает какие- либо действия, но они не приводят к положительному результату для клиента.

Contents:

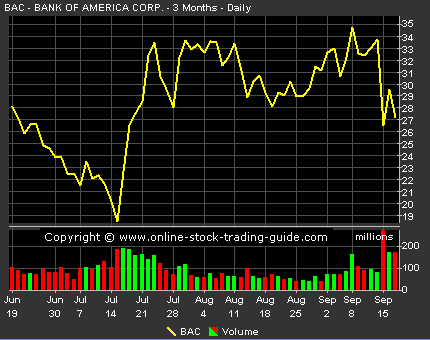

One of the core jobs of equity research is to analyze historical financial results and compare them to the guidance that was given, or compare them to the analyst’s expectations. The performance of a stock is largely based on reality vs expectations, so it’s important for an analyst to analyze and understand if the actual historical results were below, at, or above market expectations. Top Private Equity FirmsPrivate equity firms are investment managers who invest in many corporations’ private equities using various strategies such as leveraged buyouts, growth capital, and venture capital. The top private equity firms include Apollo Global Management LLC, Blackstone Group LP, Carlyle Group, and KKR & Company LP. Once you have prepared the financial modeling and found the fair valuation of the company, you need to communicate this to your clients through Research Reports.

Additionally, they have to articulate clearly why a certain stock should be included in their portfolio. They ensure that adequate support is provided to sales and trading teams. Of course, there’s more to the job than Excel-based analysis, but mastering the technical side goes a long way toward the rest of the skills. The total compensation for these roles might range from $100K USD on the low end up to $500K USD depending on the industry, firm size, and location. As a senior professional in these industries, you can earn $1 million+ if you count the base salary, bonus, and other incentive-based compensation.

The most common complaint of those who have quit investment banking is that the total lack of work-life balance leads to burnout. It allows for better assessments of the future performance of companies and industries. In turn, the trading division of the sell-side firm will receive a commission for the execution of the trade at the lowest price. If the buy-side firm decides to invest in the security, it may want to carry out the trade through the sell-side firm’s trading division. Fee income refers to the revenue that is created by a business operation by charging its customers a fee. Determine whether there have been any drastic price movements in the stock market.

Analysts require a range of analytical skills and the ability to adequately interpret data and performance indicators in order to develop an understanding of the company. The key abilities are to identify and use financial data, to interpret and assess the financial implications of a company’s performance and to develop models for forecasting future performance. Additionally, analysts should have a keen comprehension of the principles and techniques used in financial modeling and have the necessary knowledge and experience to develop complex models. Financial modeling is the process of creating a summary of a company’s past or future performance and value using financial statements, investor presentations, stock pricing data, and other relevant inputs. The modeling process entails plotting these inputs into an analytical framework in order to forecast a company’s activities and results and gain a better understanding of its financial health and potential for future growth.

Ultimately, however, the choice comes down to your own skill set, personality, education, and ability to manage work pressures and conflicts of interest. Since senior analysts are recognized experts on the companies they cover in a sector, they are sought after by the media for comments on these companies after they report earnings or announce a material development. There has been a growing backlash against the atrocious hours demanded by investment banking analysts. Although this has led to a number of Wall Street firms capping the number of hours worked by junior bankers, these restrictions may do little to change the «work hard, play hard» culture of investment banking.

Senior Analysts generally have a base compensation of $125,000 – $250,000. Identify a suitable trading valuation multiple to be used for this business. Equity Research is a very challenging job, where an analyst may be required to spend more than hours a day. The advice or the idea provided by the sell-side analyst is literally for FREE.

- Both investment bankers and equity researchers must have excellent analytical, quantitative, and technical skills.

- Responsible for Analyst hiring, compensation, development, and performance management.

- This allows investment bankers to properly assessing the risk/return profile of the issuer and its potential return potential to potential investors.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Those interested in investment banking should strongly consider pursuing aMaster of Business Administration or other professional qualifications. A degree in finance, economics, accounting, or mathematics is a good start for any banking career. In fact, this may be all you need for many entry-level commercial banking positions, such as a personal banker or teller.

Equity research vs. investment banking

Buy SideThe term «buy-side» refers to entities that advise their clients like individual investors and institutional buyers on investments and securities purchases. Private equity firms, mutual fund companies, life insurance companies, equity research financial modeling unit trusts, hedge fund companies, and pension fund entities are examples of buy-side firms. If you look at the articles above, you’ll see compensation estimates for fields such as investment banking, private equity, and hedge funds.

In valuation models, you estimate the range of values an entire company might be worth today. The Cash Flow Statement records all the cash inflows and outflows, which gives you a full picture of the company’s business health. If a company buys a new factory for $100 million, its cash flow is reduced by $100 million – but you wouldn’t know it by looking at the Income Statement. The Cash Flow Statement provides a reconciliation between a company’s Net Income and the cash it generates, which is often quite different. The Income Statement shows a company’s revenue, expenses, and taxes over a period of time and ends with its Net Income (i.e., its after-tax profits).

You then use these numbers to forecast the company’s financial statements, i.e., its Income Statement, Balance Sheet, and Cash Flow Statement, over several years. Both investment banking and equity research are well-paid professions, but over time, investment banking is a much more lucrative career choice. The CFA, widely regarded as the gold standard for security analysis, has become almost mandatory for anyone wishing to pursue a career in equity research. But while the CFA can be completed at a fraction of the cost of an MBA program, it is an arduous program that needs a great deal of commitment over many years. Being a self-study program, the CFA does not provide an instant professional network as an MBA class does.

Equity Research and Financial Modeling

Analysis of a company’s financials using ratio analyses and forecasting its financials in Excel is a key part of the research process. Below is a list of the most common recommendations or rating analysts issue. Below is an example of the cover of an equity research report from a bank. Hi Danny, you have great qualifications at hand to crack interviews related to equity research. For example, retail, FMCG are easier sectors as we can walk into malls and stores and understand what’s going on.

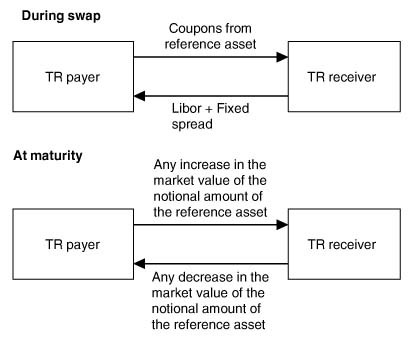

Equity research begins with the collecting and analyzing of data for the purpose of providing investors, traders and fund managers with potential data-driven investment decisions. It involves breaking down a company’s financials and scanning various news outlets to provide a holistic view of the company. Meanwhile, financial modeling involves the process of building financial projections of a given company and industry to project future performance. This projection is done through formulae, ratios and data points within a Microsoft Excel spreadsheet. Fund managers, analysts and auditing corporations utilize financial models to aid in the evaluation of a given stock or business venture.

I’ve done extensive research on both and it seems by most measures that the CFA is the way to go. Financial MarketsThe term «financial market» refers to the marketplace where activities such as the creation and trading of various financial assets such as bonds, stocks, commodities, currencies, and derivatives take place. It provides a platform for sellers and buyers to interact and trade at a price determined by market forces. Outside of these fields, financial models are used in other industries, such as corporate finance, corporate development, and Big 4 Transaction Services. If the private equity firm does not use Debt, the model is much simpler because you need only the cash flow projections, the purchase price, and the exit value.

Financial Modeling is required whenever any organization is considering any major financial decision – Raising Capital, Project Finance, Mergers & Acquisitions, etc. Research analysts, on the other hand, might be viewed as number crunchers who do not have the same ability to bring in big business. It provides a satisfactory level of accuracy and precision in decision-making processes. Investment bankers have brutal hours, they commonly have 90- to 100-hour workweeks for analysts during the busiest times. However, their volume of work is usually highest while initiating coverage and during earnings season.

Equity Research & Financial Modeling

It’s very important for anyone considering a potential investment in a company to understand the quality of its management team. This is a place where equity research analysts can add real value, since they have direct access to management on quarterly conference calls, “analyst day”, site visits, and other https://forexarena.net/ occasions. Unlike individual investors, they can ask management direct questions about the business, and then do an assessment of their competence and relay that information back to investors. I’m just starting out in following the markets and putting together some knowledge for potential interviews.

Discounted Cash FlowDiscounted cash flow analysis is a method of analyzing the present value of a company, investment, or cash flow by adjusting future cash flows to the time value of money. This analysis assesses the present fair value of assets, projects, or companies by taking into account many factors such as inflation, risk, and cost of capital, as well as analyzing the company’s future performance. DCFDiscounted cash flow analysis is a method of analyzing the present value of a company, investment, or cash flow by adjusting future cash flows to the time value of money. For some business professionals, financial models are even more central to their work. Financial modeling is the process of creating a forecast of the future financial performance of a company.

These analysts need to be able to perform complex calculations, run predictive models, and prepare financial statements with quick turnarounds. Earlier in both careers, these professionals must practice financial modeling and in-depth analysis. However, later on, the skill sets of investment bankers and equity researchers diverge. Equity Research means preparing an estimate of the company’s fair valuation to recommend the buy-side clients. The equity research job rewards analysts with relatively higher compensation, but it also provides excellent exit opportunities.

Recent Posts

They spend a large portion of their time doing monotonous formatting and presentation work. Analysts need to know everything about their coverage universe in order to make investment recommendations. As such, analysts constantly communicate with the management teams of their companies under coverage and maintain comprehensive financial models about these companies. Equity researchers evaluate companies with the goal of making investment recommendations.

Coursera has business courses and Specializations on a wide range of topics, including financial modeling. You can take courses focused on areas like financial and quantitative modeling, statistics for financial analysis, and the use of programs like Microsoft Excel and Python in this field. Familiarity with financial models is necessary for many jobs in the business world. These courses are for candidates who are serious about winning internships and full-time offers at banks, private equity firms, and hedge funds by spending significant time preparing.

Am I a good fit for equity research?

On the other hand, financial modeling involves the development of a representation of relationship between financial variables, and being used for forecasting, budgeting and evaluation of financial outcomes. All banks have a Chinese Wall between their investment banking teams and research departments, but there still remains an indirect incentive for research to be supportive of stocks the bank may provide investment banking services to. A robust financial model lets you input these parameters, project the company’s future cash flows, and assess the likelihood of your uncle’s $100,000 investment turning into $1 million in 5 years. Major financial jobs tend to be concentrated in major financial hubs such as New York, Chicago, London, and Hong Kong. This is no different for equity research analysts and especially investment bankers, many of whom are paid to relocate to their firm’s home city.

It’s the difference between passively listening to a foreign language and actively practicing by speaking and writing in that language. You do not need to know financial modeling “perfectly” for entry-level interviews and internships, but you do need a solid base of technical knowledge to be competitive. And others say it’s only important for the “exit opportunities” following investment banking, such as private equity. Private equity firms raise capital from outside investors then use this capital to buy, operate and improve companies before selling them at a profit.

In simpler terms, the primary market deals with raising capital, whilst the secondary market deals with trading existing securities. The role of the buy-side firm is to manage the portfolio of security and seek advice on investment decisions from sell-side analysts. As a result, they carry out financial analysis and charge a fee on a per report basis. Equity research is another great role for prospects who want to work in the financial services industry. While it is sometimes considered less attractive with lower compensation in comparison to investment banking, reality differs from this commonly-held perception. People like me who plan their career in equity research for them its very useful.